Maintain Gl Posting Parameters

The Maintain GL Posting Parameters routine allows the user to set the details for General Ledger postings that are to be used throughout the application. These settings ensure that postings occur to the proper accounting month and year, and that only users granted the proper authority can override the set system posting regulations (i.e. using the Accounting and One Sided Journal Entry passwords).

Since making changes to the parameters that are regulated through this routine will affect all Accounting and General Ledger transactions, balances, and records, it is available to only those users who have been granted access rights.

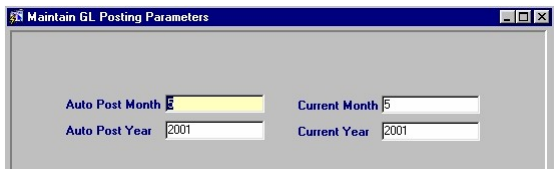

For more information, see GL Posting Scenarios, which should be taken into consideration before making changes to Posting Parameters. When the Maintain GL Posting Parameters routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

Auto Post Month - The number of the accounting month to which eQuinox currently posts all General Ledger Journal Entries. To change the Auto Post Month, the user may simply manually enter the number representing the new month. This feature allows the user to enter information into two accounting months. For example, the Firm may decide to keep their Month End open for a few days, allowing entries to be made to both the accounting month that is in the process of being closed, and the new accounting month. To enable this feature, keep the Current Month as the month that is being closed, and change the Auto Post Month to the new accounting month. Note: This feature is primarily for automatic postings by Non-Accounting staff, who do not have the option of selecting the posting month. Accounting Staff always have the option of selecting the posting month.

Auto Post Year - The accounting year to which eQuinox posts all General Ledger Journal Entries. To change the Auto Post Year, the user may simply manually enter the number representing the new year. This feature can be used in conjunction with Month 13; while the Firm is making Year End postings/adjustments to Month 13, the Auto Post Year can be changed to the new Accounting Year, allowing entries to both Accounting Years.

Note: The Current Month and Current Year fields tell the user whether the current Accounting Year (i.e. as indicated in the Auto Post Month and Auto Post Year fields) is the same as the current Calendar Year. For example, a Firm's new Accounting Year starts in October 2003; after that date, postings will be made to Month 1, Year 2004, while the actual Calendar Date will be Month 10, Year 2003.

Current Month - This field displays the number of the current Calendar Month. To change the Current Calendar Month, the user may simply manually enter the number representing the new month.This feature can be used in conjunction with Auto Post Month to allow the user to enter information into two accounting months.

Current Year - This field displays the current Calendar Year. To change the Current Accounting Year, the user may simply manually enter the number representing the new year. Note: Although the user can change the Current Calendar Year here, they must access the Process Year End routine to perform the Year End Closing procedures.

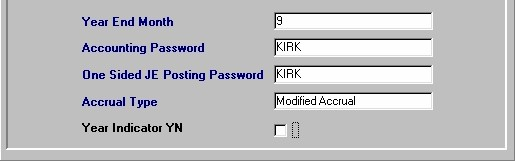

Year End Month - The number of the calendar month which represents the Firm's Fiscal Year End. Once this month is reached, the Firm must begin their Year End procedures.

Accounting Password - The password that must be entered before a user can post entries to a closed accounting period. The maximum length of the accounting password is 15 characters. Note: This feature should be used with caution, as it will affect the GL closing balances! See Post Journal Entries for more information.

One Sided Je Posting Password - The password that must be entered before a user can post one-sided or unbalanced transactions. The maximum length of the one sided journal entry posting password is 15 characters. Note: This feature should be used with caution, as it will affect the GL balances! See Post Journal Entries for more information.

Accrual Type - The type of Accrual to be applied throughout the system (i.e. Full Accrual, Modified Accrual, Full Cash). A selection may be made from the List of Values provided. Note: Changing the Accrual Type has a potentially large accounting impact, as it will change the way in which the entire accounting system operates. Also, when the Accrual Type is changed, Journal Entries may be required.

Year Indicator YN - The Yes/No value of this field indicates whether the Accounting Year is the same as the Calendar Year it starts in or the Calendar Year it ends in. If the Accounting Year ends in the same year as the Calendar Year, the user must "check" this field; if the Accounting Year starts in the same year as the Calendar Year, the user must leave this field "unchecked".

Once the user has finished entering or updating information, they must click the Save button or press F10 to commit the changes to the database.

The Accrual Basis of Accounting recognizes revenue in the period in which it is earned, and deducts in the same period the expenses incurred in generating this revenue. This type of accounting stresses the matching of revenue and related expenses. The alternative to using the Accrual Basis of Accounting is the Cash Basis, where revenue is not recorded until it is received in cash, and expenses are assigned to the period in which cash payment is made.

- Full Accrual - If the Firm uses Full Accrual, then WIP is considered revenue as soon as it is posted (i.e. Billable time immediately becomes income).

- Modified Accrual - Also known as Modified Cash. If the Firm uses Modified Accrual, revenue is recognized at the time of billing (i.e. WIP is not considered revenue until it is billed).

- Full Cash - If the Firm uses the Full Cash basis of accounting, revenue is not recognized until the cash is received.