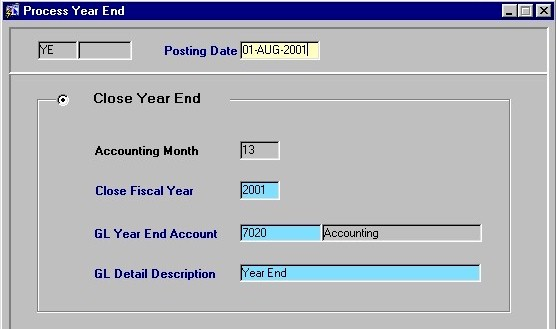

Process Year End

The Process Year End routine allows the user to close the current accounting year or to reverse the last year end closing procedure. At the end of each accounting year, the user must formally close the year through this routine. Once this has been completed, the new accounting year will be displayed and used throughout the rest of the application. When the year is closed, all fiscal year end closing entries are posted to month 13; all revenue and expense accounts are cleared to this month and reset to zero.

Before performing the Year End processing, the user should review the GL Posting Scenarios document.

Field Definition

Journal Type, Journal Number - The Year End processing is tracked by a journal; here, the type of journal that is used to track year end closings (i.e. YE) and the journal number is displayed. This field cannot be edited by the user, but will update automatically to the next number when a new Journal is started (i.e. a new Journal is started after each Year End processing is performed).

Close Year End - To close the current accounting year and perform Year End processing, the user must select this option.

Accounting Month - This field displays the number of the accounting month currently open. Although this field cannot be edited by the user, it will update automatically to the number of the new month when the user starts the Month End Procedures for the current month (i.e. through the Month End Processing routine).

Close Fiscal Year - The number of the accounting year that is currently being closed. This field defaults to the accounting year that is currently open, but may be overridden by entering a different year in YYYY format.

GL Year End Account - The number and description/name of the General Ledger account to which all clearing entries will be posted. A selection may be made from the List of Values provided.

GL Detail Description - In this field, the user can manually enter a description/explanation for the General Ledger entries.

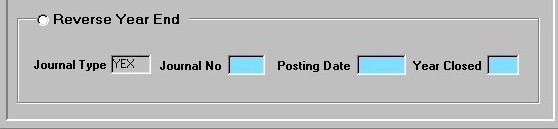

Reverse Year End - To reverse the last Year End processing, the user must select this option and then enter the information for the year being reversed.

Journal Type - The Year End Processing Reversal is tracked by a journal; here, the type of journal that is used to track updates made in this routine is displayed. This field cannot be edited or updated by the user.

Journal No - The journal number is automatically displayed. This field cannot be edited by the user, but will update automatically to the next number when a new Journal is started (i.e. a new Journal is started after each Year End Processing Reversal is performed).

Posting Date - The date to which General Ledger clearing entries will be posted. This field defaults to the current system date, but may be overridden by making a selection from the calendar provided.

Year Closed - The number of the accounting year that is currently having it's closing reversed. The user must manually enter the year in YYYY format.

Once the user has finished entering or updating information, they must click the Save button or press F10 to commit the changes to the database.