Post Levies

The Post Levies routine allows the user to see a list of Client/Matter files that have attracted a transaction levy surcharge (i.e. as a result of disbursement postings) and to post these levies against the file as an additional disbursement on the file. This product does not account for the volume surcharge, which depends on the Firm's total gross billings.

Note: Transaction Levy Surcharges apply solely to the province of Ontario. The Lawyers Professional Indemnity Corporation (LPIC) is responsible for professional liability insurance for Lawyers in Ontario. Two transaction surcharge levies and a volume surcharge levy have been part of the insurance programs since April 1905. Each Civil Litigation transaction and each Real Estate transaction will attract a flat levy surcharge, regardless of the number of documents registered pursuant to each transaction (i.e. each file of these types can only have ONE levy posted against it). For Matters opened after January 1, 1906, the flat levy surcharge fee is $50.00. For Matters opened before January 1, 1906, the fee is $25.00. Documentation and payment of surcharges with respect to these transactions must be provided to the Law Society quarterly.

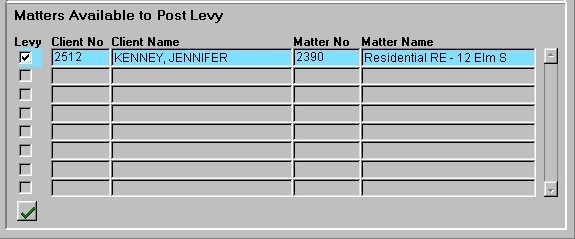

When the Post Levies routine is accessed from the eQuinox main menu, the screen shown below will be displayed. If the Firm's system has not been set up to deal with Levy charges (i.e. the Ontario Levy field in the Maintain Client File Parameters routine MUST be checked), the user will be alerted with a message when attempting to launch this form, and the form will close. In addition, if there are currently no valid Client/Matter records to which levies can and/or should be posted, the user will be alerted with a message when attempting to launch this form, and the form will close.

Field Definition

The first two fields on the form display the Journal Type (i.e. DS) and the Journal Number (i.e. 12). A new Journal is started automatically after each posting.

Date - The date on which the Levies are being posted. This field automatically defaults to the current System date, but this may be changed by making a selection from the Calendar provided or by manually entering a different date.

Acct Period - The Month (in number format) and Year of the Firm's current Accounting Period. This field automatically defaults to the current Accounting Period, but this may be changed by manually entering a different period. Note: Depending on the Firm's preferences (as indicated in the Firm Parameters routine), the user may be alerted with a message when posting the Levies, and asked to verify the Accounting Period; this is used to ensure that all transactions occur within the correct Accounting Period.

Once the user has tabbed out of the Accounting Period field, a query is automatically executed. All Matters that have attracted a Transaction Levy Surcharge will be returned in the query results. This information cannot be edited or updated by the user.

Levy - The Yes/No (i.e. checked/unchecked) value of this field indicates whether or not the user wishes to post the already attracted Transaction Levy Surcharge. Since Transaction Levy Surcharges can only be applied to the same Matter once, those files that have already had the Levy posted against it will no longer appear in this list. If a Levy has not been posted against a file, that file will remain in this list for future postings.

Client No, Client Name - The unique identifier and name of the Client associated with the current record.

Matter No, Matter Name - The unique identifier and name of the Matter.

To complete the process and save the information, the user must either click the Save button on the menu or press F10 on their keyboard.